Aligning Capital with Our Mission

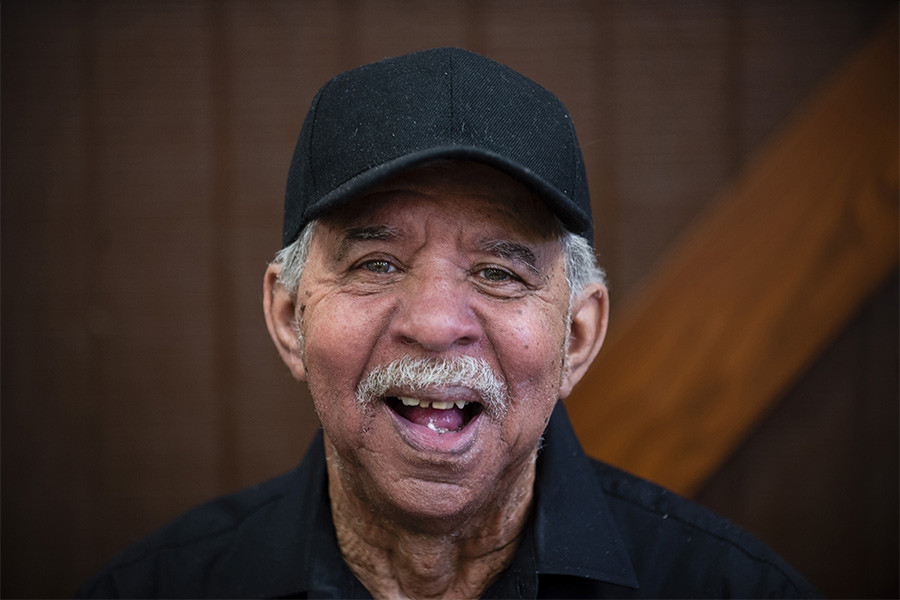

As an impact investing foundation, we empower underserved Carolinians to self-sufficiency through investments that generate both competitive returns and lasting community impact.

What is Impact Investing?

Impact investing is the practice of making investments with the intention to generate both financial returns and measurable social impact. As an impact investing foundation in NC and SC, The Leon Levine Foundation represents a powerful extension of our grantmaking work, allowing us to deploy capital while directly advancing our mission to empower underserved Carolinians and strengthen our Jewish community.

Since we began exploring impact investing in 2019 and made our first intentional investment in 2021, we have deployed capital across more than a dozen impact-aligned investments that are helping to build stronger communities across North and South Carolina.

Impact investing allows us to address critical challenges, like the affordable housing crisis, at a scale that grants alone cannot achieve. It’s a commitment to ensuring that every dollar entrusted to us works in service of both financial strength and social good.

Our Impact Investing Philosophy

Impact investing is a core component of how we advance our mission. We believe that strong financial returns can and must exist alongside intentional, measurable social impact. Our philosophy is grounded in non-concessionary risk-adjusted market performance: we expect the same rigor, discipline, and accountability from our impact investments as from any other asset class.

Over time, we are committed to moving our portfolio toward 100% mission alignment, ensuring that every dollar entrusted to us works in service of both financial strength and social good.

How Impact Investments Complement Our Grantmaking

This approach is tightly integrated into our grantmaking, program teams, and research and evaluation processes. Both grants and impact investments provide pathways to long-term support and sustainable solutions, offering complementary tools for addressing community needs. Together, they form a comprehensive strategy for community transformation.

Our Target Returns

We seek competitive, market-rate financial returns that align with the risk profile of each investment, while simultaneously generating measurable social impact. This dual mandate ensures the sustainability of our foundation's work for generations to come.

Geographic Focus

Our impact investments leverage deep community relationships, local knowledge, and our grantmaking expertise to maximize both financial and social returns. Our grantmaking strategy is place-based, focusing on North and South Carolina. Therefore, when investment opportunities arise within the Carolinas, they are particularly exciting for us as they allow us to deepen our impact in the communities we know best.

Our Investment Approach

We deploy capital through various investment structures, each chosen to align with the specific opportunity and impact. To date, our capital is invested in market-rate impact funds or co-investments alongside trusted partners.

Investment sizes and terms vary based on the opportunity, structure, and anticipated impact. We work closely with each investment partner to structure deals that meet both their needs and our investment criteria.

Measuring Our Impact

We will track rigorous impact metrics across our portfolio, with specific key performance indicators tailored to each sector and investment. Our approach to impact measurement is guided by the same discipline and accountability we apply to financial performance, ensuring that our investments deliver on both dimensions of our dual mandate.

Mission Alignment

We focus our investments in verticals most aligned with our grantmaking work

Affordable Housing

Creating and preserving quality housing that serves as the foundation for economic mobility and self-sufficiency.

Economic Mobility

Supporting workforce development, small business growth, and financial inclusion.

Healthcare Access

Expanding access to quality healthcare services in underserved communities.

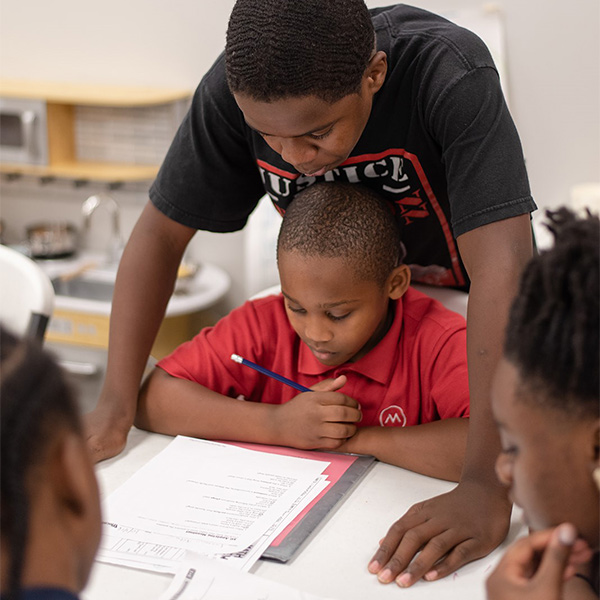

Education Technology

Advancing innovative solutions that improve educational outcomes.

Investment Criteria

We evaluate potential impact investments based on four key criteria:

Mission Alignment

Investments must directly advance our mission to empower underserved Carolinians to be self-sufficient and strengthen our Jewish community. We prioritize opportunities in affordable housing, economic mobility, healthcare access, and education technology that serve North and South Carolina communities.

Financial Sustainability

We seek investments that demonstrate strong financial fundamentals and the potential for risk-adjusted market returns. Organizations must show a clear path to financial sustainability and the ability to meet their obligations.

Measurable Impact

Every investment must have clearly defined, measurable impact goals with regular reporting. We work with investment partners to establish metrics that capture both outputs (activities completed) and outcomes (changes achieved) in the communities we serve.

Organizational Readiness

Investment partners should demonstrate:

- Strong leadership and management capacity

- Proven track record or clear potential in their sector

- Robust financial systems and reporting capabilities

- Alignment with TLLF values and approach

- Ability to absorb and effectively deploy capital

Meet the Team

If you believe your organization, strategy, and proposal fit our specific impact- and financial-aligned criteria, you may submit your materials to impactinvesting@llmanagementinc.org.

Please note that we can only respond to those proposals that we believe meet our criteria.

Resources & Learning

For Philanthropic Peers

We are grateful to be in this work alongside so many talented and aligned investors, and we’re committed to sharing what we learn. As foundations increasingly recognize the power of impact investing, we believe in the importance of collaboration and knowledge-sharing across the sector.

Frequently Asked Questions

Grants provide non-repayable support for nonprofit organizations providing mission-aligned services in North and South Carolina. Impact investments are structured with the expectation of repayment (and often financial returns), allowing that capital to be recycled into future investments. Both play important roles in our overall strategy.

Our investment timeline varies by opportunity complexity, but we work to move efficiently while conducting thorough due diligence. We invest across multiple regions, leveraging our deep community relationships and knowledge to maximize impact.

We seek non-concessionary, risk-adjusted market returns that align with the specific investment structure and asset class. We do not accept below-market returns for impact.

Impact measurement is tailored to each investment but always includes clearly defined metrics, regular reporting, and accountability for outcomes. We work with investment partners to establish appropriate metrics during the investment structuring process.

Our Commitment

As a 100% impact investing foundation, The Leon Levine Foundation is committed to ensuring our entire portfolio is mission-aligned, where every investment decision reflects our values and advances our vision of empowered, self-sufficient communities across the Carolinas.

Impact investing is not a separate strategy for us; it is integrated into everything we do. It represents our belief that capital markets can and must be a force for good, and that the pursuit of financial returns and social impact is not only compatible but mutually reinforcing.

As we continue to build our impact investing portfolio, we remain committed to:

- Discipline and rigor in both financial and impact performance

- Transparency and learning with our peers and partners

- Innovation and adaptation as markets and community needs evolve

- Deep community engagement in the Carolinas we serve

- Long-term thinking that ensures sustainable impact for generations to come

We look forward to collaborating with aligned investors, fund managers, and organizations in the years ahead. Together, we can create lasting change that empowers underserved Carolinians and builds thriving communities across North and South Carolina.